There is no restriction on NRIs for repatriating rental income or even property sale proceeds (except agricultural land, a farmhouse and plantation property) as long as the total proceeds are within the stipulated limit of $1 million in a fiscal year.

The conditions for availing this facility are:

- The property being sold was acquired as per the foreign exchange regulations applicable during that period.

- The amount being repatriated cannot exceed the cost of the sale proceeds.

- The sale proceeds from a maximum of two residential properties can be repatriated.

- The maximum amount of repatriated funds from a Non-Resident Ordinary (NRO) account is capped at $1 million per fiscal year.

- Funds can be repatriated only after settling all the applicable taxes and other charges.

If the property was purchased with money received from inward remittance or debit to NRE/FCNR/NRO account, the entire principal amount can be repatriated outside India immediately while the balance must be deposited in an NRO account.

To start the repatriation process, the NRI must get a certificate from a chartered accountant in India, issued in a form called 'Form 15CB' available on the income tax website of India. Submission of this form confirms that the money acquired was via legal channels and all outstanding taxes have been cleared. The CA verifies and signs the form.

The next step is to fill another form called 'Form 15CA' which can also be downloaded from the same website. The form must be filled and submitted online, The NRI must print out the filled undertaking of Form 15CA displaying the system-generated acknowledgement number and sign it.

To complete the process, the signed undertaking along with the CA certificate on Form 15CB needs to be taken to the bank where one has an NRO account. The concerned bank will check the forms and transfer the money abroad (up to $1 million in an FY). Apart from these forms, the bank will also ask for a copy of the sale document of the property. If the property has been inherited, the bank will ask for the copy of the Will , legal heir certificate, and death certificate of the person on whose demise the property was inherited.

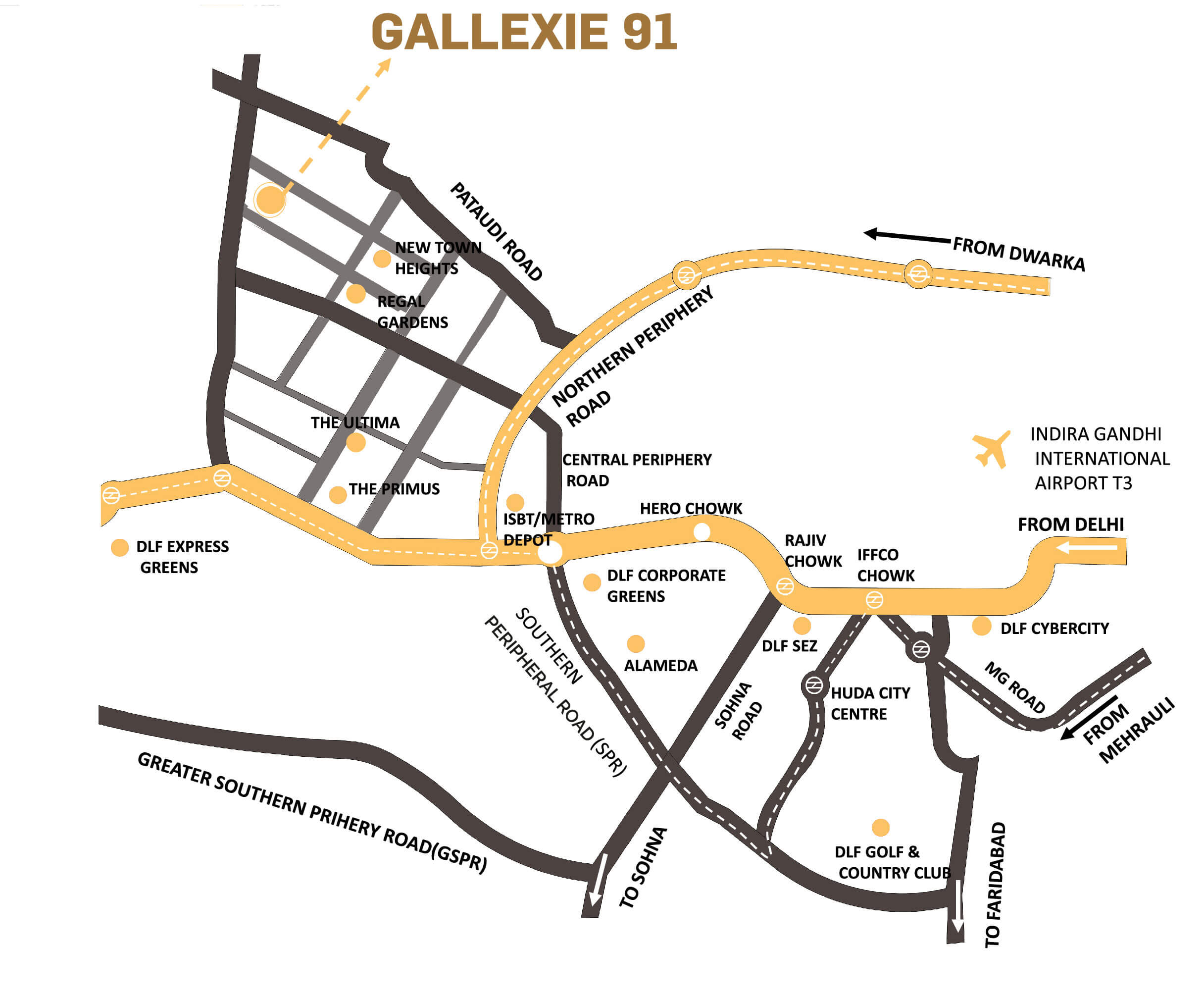

See on Google Maps

See on Google Maps