PINNACLE CLUBHOUSE

The estate’s architectural centerpiece, situated at the water’s edge. This elite social sanctuary offers refined spaces for social as well as private gatherings.

Club Lake Reserve is an elite residential sanctuary situated within the sprawling 25-acre integrated tourism ecosystem of Club Lake. This gated enclave is anchored by the breathtaking 12-acre Vale Lake, offering a lifestyle that is increasingly rare: absolute privacy paired with high-yield financial performance. While traditional real estate remains a passive asset, Club Lake Reserve introduces a paradigm shift as India’s first branded land offering a 12% Assured Return. This unique "Income-Generating Land" model ensures that your investment begins yielding results from day one, even as the strategic location in the Sindhudurg-North Goa corridordrives exponential capital appreciation.

Read moreSindhudurg, Maharashtra

Branded Villa Plots

Club Lake Reserve is an elite residential sanctuary situated within the sprawling 25-acre integrated tourism ecosystem of Club Lake. This gated enclave is anchored by the breathtaking 12-acre Vale Lake, offering a lifestyle that is increasingly rare: absolute privacy paired with high-yield financial performance.

While traditional real estate remains a passive asset, Club Lake Reserve introduces a paradigm shift as India’s first branded land offering a 12% Assured Return. This unique "Income-Generating Land" model ensures that your investment begins yielding results from day one, even as the strategic location in the Sindhudurg-North Goa corridordrives exponential capital appreciation.

Some people look for amenities. A few live beside them. Only a rare few wake up at the heart of them. While many developments offer a "view" of water, the Club Lake Reserve is the only enclave where your lifestyle is physically anchored to 12 ACRE Vale Lake.

Positioned at the most strategic elevation of the entire 25-acre township, Club Lake Reserve offers a double-vantage point that is impossible to replicate:

• The Blue View: Uninterrupted, 270-degree vistas of the shimmering 12-acre lake.

• The Social Hub: Direct, "next-door" proximity to the Pinnacle Club—the largest clubhouse North of Goa.

You are located exactly where the serenity of the water meets the energy of the estate’s landmark social life.

Don’t just wait for land to appreciate. Make it pay you while you wait.

Club Lake Reserve is India’s only Branded Land offering a 12% assured return*. We provide the security of a physical asset with the liquidity and cash flow of a high-yield business.

You earn from Day 1, ensuring your capital starts working the moment you invest.

While the 12% yield provides immediate income, the long-term wealth is built on the "Supply-Demand Mismatch " Premium lakeside land—situated in a high-growth corridor near an International Airport—is a finite resource.

The "MOPA Effect" & The Sindhudurg Revolution Sindhudurg has transitioned from a hidden gem to India’s most strategic tourism and investment hub. As North Goa reaches saturation, savvy investors have shifted to this pristine coastal belt.

Investing here isn't just about a location; it's about owning the future of the Konkan Riviera.

At Club Lake Reserve, amenities are not merely additions; they are an extension of the natural landscape, designed to offer a life of curated indulgence. The master plan centers around the shimmering Vale Lake, ensuring that every world-class facility is anchored by tranquil water views and the lush greenery of the Konkan.

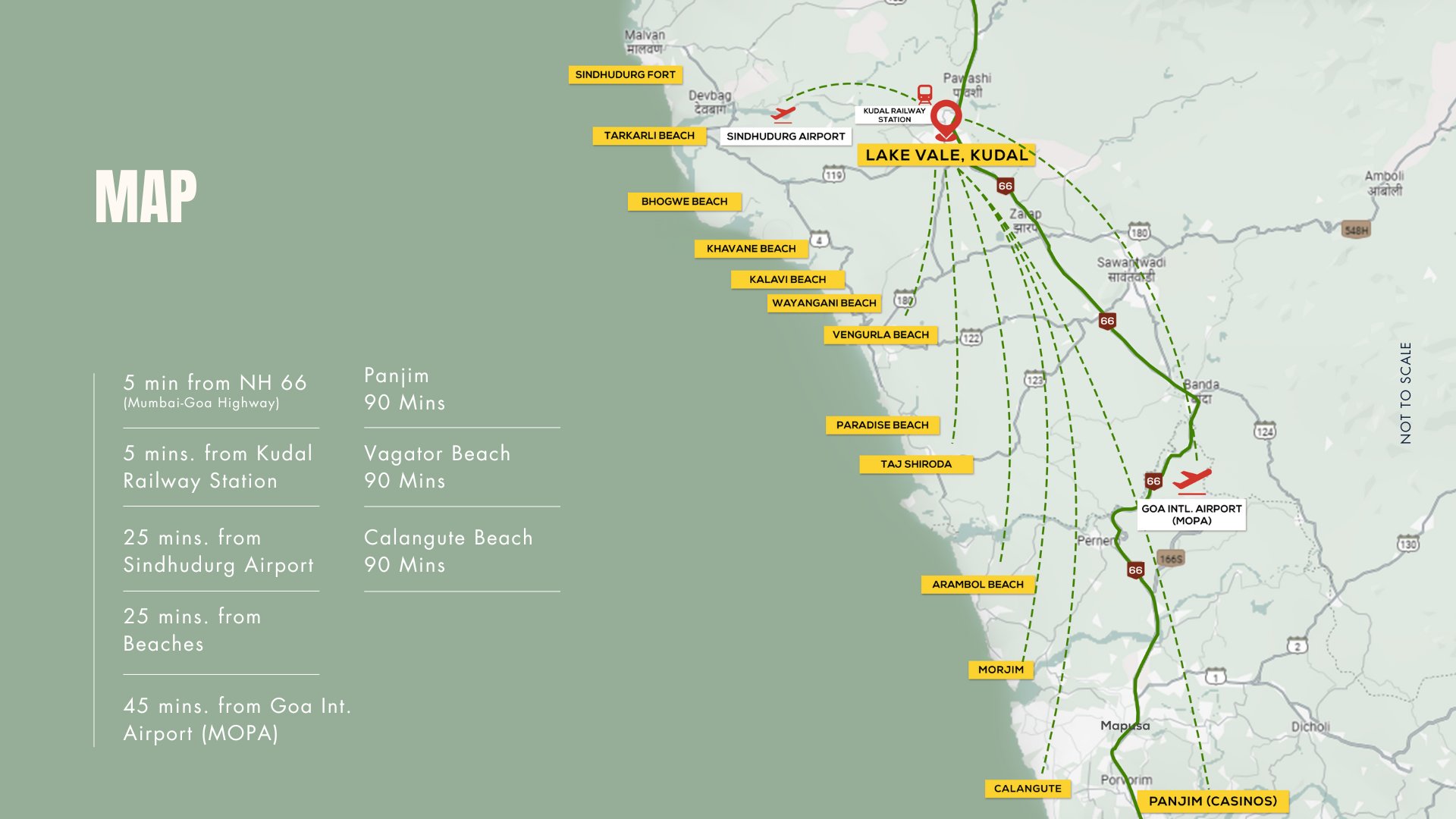

Unveil the charm of THE Club Lake, perched at the trijunction of Goa, Maharashtra, and Karnataka. With seamless connections via road, rail, and air, this lakeside oasis beckons adventurers and tranquility seekers alike.

Answers to frequently asked questions about The Origin

The fundamental list of property documents that an NRI needs while purchasing property in India are:

Below is the list of documents an NRI needs while purchasing or investing property in India:

It is crucial for NRIs to have a PAN card because they will be required to file income tax returns if they have rented out property. Besides, in case the property is sold later, the capital gains resulting from the sales would be subject to capital gains tax. Capital gains would be included in the total income while it is being taxed.

If you are an NRI and don't visit India frequently, it is much more convenient to execute the sale, registration, possession, and other processes by granting a special power of attorney to someone in the city where you are buying a property.

If you are an NRI, you need to submit the address proof of your current residence attested by the Indian Embassy in your country of residence.

Yes, NRIs can apply for home loan from any approved banking partner of the project. They can also apply loan from other banks.

If you are a salaried NRI and considering applying for a home loan, you would need the following sets of documents:

There is no restriction on NRIs for repatriating rental income or even property sale proceeds (except agricultural land, a farmhouse and plantation property) as long as the total proceeds are within the stipulated limit of $1 million in a fiscal year.

The conditions for availing this facility are:

If the property was purchased with money received from inward remittance or debit to NRE/FCNR/NRO account, the entire principal amount can be repatriated outside India immediately while the balance must be deposited in an NRO account.

To start the repatriation process, the NRI must get a certificate from a chartered accountant in India, issued in a form called 'Form 15CB' available on the income tax website of India. Submission of this form confirms that the money acquired was via legal channels and all outstanding taxes have been cleared. The CA verifies and signs the form.

The next step is to fill another form called 'Form 15CA' which can also be downloaded from the same website. The form must be filled and submitted online, The NRI must print out the filled undertaking of Form 15CA displaying the system-generated acknowledgement number and sign it.

To complete the process, the signed undertaking along with the CA certificate on Form 15CB needs to be taken to the bank where one has an NRO account. The concerned bank will check the forms and transfer the money abroad (up to $1 million in an FY). Apart from these forms, the bank will also ask for a copy of the sale document of the property. If the property has been inherited, the bank will ask for the copy of the Will , legal heir certificate, and death certificate of the person on whose demise the property was inherited.

It is obviously very important for an NRI to pay attention to factors like the legitimacy of land, compliances to be followed during construction, environmental clearances, among other considerations, at the time of purchasing property. Given that real estate is a state subject, laws may differ from state to state and there is, therefore, no universally applicable response.

To get clarity on the status of a project, NRIs should preferably consult a lawyer to examine all the legal documents and verify their authenticity. In addition to common concerns, a major factor that they need to look into is whether the project is registered under the respective state RERA and whether it is fully RERA-compliant. However, due to the absence of an operational RERA website in many states & UTs, touching base with a reputed real estate consultancy can help save time and effort, and ensure that everything is in order.

It is not recommended for NRIs to file property dispute cases anywhere other than the jurisdiction where the property is located. This is because only the court in that particular jurisdiction can try a property-related case.

Delays in the construction process beyond the extension period mentioned in the agreement fall within the purview of 'deficiency in rendering of service' under the Consumer Protection Act of 1986 if the project is not registered under state RERA. Such cases are tried by the consumer courts. On the other hand, if the project is registered under RERA, buyers can lodge a complaint against the builder under Section 31 of the regulation with the relevant regulatory authority within the respective state.

In cases of transactions wherein the individual selling the property to an NRI is a resident Indian, TAN number is not required. However, it is needed in case the property is purchased from a Non-resident Indian.

PAN Card is not required for an NRI as they are non-resident Indians with Indian passports; this is applicable particularly if they do not intend to invest money into any business in India. However, it is mandated by the government to own a PAN Card if: